Rare earth elements play an indispensable role in the global high-tech supply chain, encompassing electric vehicles, batteries, semiconductors, wind power generation, and even defense equipment. However, the increasing geopolitical risks associated with rare earth resources have created a serious bottleneck effect, which not only affects the future of the industry but also becomes a focal point in international trade negotiations.

Supply Landscape: The Dual Challenges of Concentration and Dependence

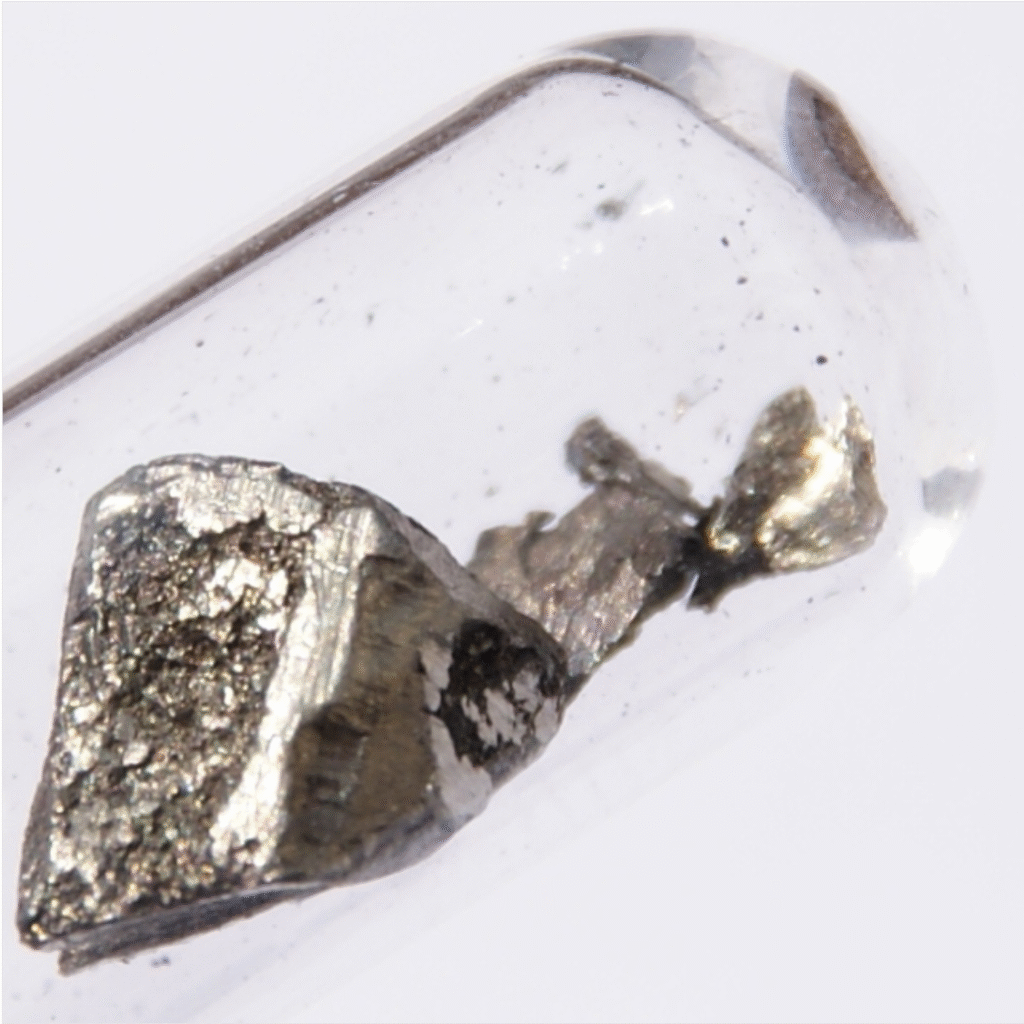

China currently controls approximately 70% of the world’s rare earth minerals and over 90% of heavy rare earth processing capacity, particularly in key elements such as neodymium, dysprosium, and terbium, achieving a de facto monopoly. This advantage stems from years of strategic investment and abundant natural resources, making it difficult for other countries to catch up in the short term. Even if the United States reopens mines in the California Sierra and increases investment in processing facilities, the overall supply chain will remain significantly dependent on China.

Processing Bottleneck: The Global Shortcoming of Heavy Rare Earth Elements

While light rare earths are being mined in many locations around the world, the separation and processing of heavy rare earths remains a technology- and investment-intensive challenge. The closure of Vietnam’s only concentrator plant due to a tax dispute has further exacerbated the market’s dependence on Chinese processing plants. Australian and Malaysian companies have begun gradually producing heavy rare earths, but limited output makes it difficult to quickly alleviate market pressure.

Intensified Political Gambling: Export Restrictions and Trade Tensions

In 2025, China implemented a strict rare earth export licensing system, particularly for products containing medium and heavy rare earth elements. This was seen as a response to US trade restrictions and foreshadowed a future of regular legal battles. Despite massive investments in efforts to build an independent supply chain, the US faces long supply cycles, making rapid changes difficult and placing it on the defensive in the short term.

Industry Impact and Future Outlook

Sudden disruptions in the supply of rare earth elements pose a significant threat to chip manufacturing, electric vehicles, and military equipment. The International Energy Agency predicts that by 2030, China will still control over 50% of rare earth minerals and account for over 70% of global processing capacity. Although many countries are accelerating rare earth projects, the long construction cycle for new capacity makes it difficult to alleviate global supply bottlenecks.

Rare Earth Bottleneck Tests Global Strategy

The scarcity and concentration of rare earth resources have become a “weak link” in the global high-tech industry chain. Future international relations and technological competition will be shaped by this critical area. Ensuring supply diversification and independent control has become an essential step in reshaping the global industrial chain. Strategic patience and sustained investment are the only keys to overcoming this bottleneck.

Leave a Reply